The credit card offers and convenience checks you get in the mail are

more than just a nuisance; they also increase your risk of identity

theft and credit card fraud. With a few simple phone calls, you can stop

unwanted junk mail and lower your risk of becoming a victim of a crime.

Credit card offers

Under federal law, credit card companies may send unsolicited offers based on your credit score and information contained in your credit report. The three major credit reporting companies compile a list of prescreened consumers; credit card companies then use the list to solicit new customers. Although not all credit card offers come from these prescreened lists, a majority of them do. Fortunately, federal law gives you the right to opt out of receiving these offers. You may opt out for five years or have your name removed from prescreened lists permanently.

Under federal law, credit card companies may send unsolicited offers based on your credit score and information contained in your credit report. The three major credit reporting companies compile a list of prescreened consumers; credit card companies then use the list to solicit new customers. Although not all credit card offers come from these prescreened lists, a majority of them do. Fortunately, federal law gives you the right to opt out of receiving these offers. You may opt out for five years or have your name removed from prescreened lists permanently.

To opt out for five years, you will submit some information to the major credit reporting companies at www.optoutprescreen.com

or by calling 888-567-8688. You will be required to provide your name

and address. Your Social Security number and date of birth will also be

requested, but this information is not required. Providing your Social

Security number and date of birth will, however, help ensure that your

name is removed from prescreened lists.

If you want to opt out of prescreened offers permanently,

you will also visit www.optoutprescreen.com or call 888-567-8688. You

will be required to mail in a "Permanent Opt-Out Election" form, which

can be printed off the Web site or requested by telephone. Once your

form is processed, your name will be removed from prescreened lists

permanently. Cessation of prescreened offers may take up to 60 days. The information provided through www.optoutprescreen.com

and 888-567-8688 is kept confidential. The Web site and phone number

are set up by the major credit reporting companies as required by law.

Before you give your personal information to a different company,

conduct research to make sure the company is reputable.

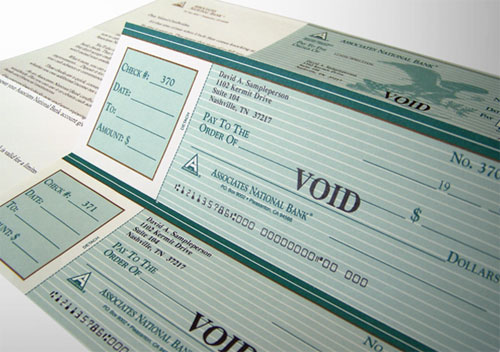

Convenience checks

You may also be receiving what are called "convenience checks." These are checks that come from your current credit card company and are either blank or written for large amounts of money. If you use these checks, the amount will be added to your credit card balance, often at a high interest rate.

You may also be receiving what are called "convenience checks." These are checks that come from your current credit card company and are either blank or written for large amounts of money. If you use these checks, the amount will be added to your credit card balance, often at a high interest rate.

You have the ability to stop receiving

convenience checks. Call your credit card company and insist that your

name be removed from the list of consumers who receive convenience

checks.

Limiting the number of companies and people with access to your personal

information will reduce your risk of identity theft and fraud. Part of

protecting your personal information is knowing your rights as a

consumer. The Johnson County District Attorney's Office is charged with

helping consumers protect their rights. If you feel that a business has

misled you, don't hesitate to call the Johnson County District

Attorney's Fraud Hotline, 913-715-3140.

No comments:

Post a Comment