WASHINGTON, D.C.— Attorney General Eric Holder and Department of Health and Human Services (HHS) Secretary Kathleen Sebelius released a new report showing that the government’s health care fraud prevention and enforcement efforts recovered nearly $4.1 billion in taxpayer dollars in fiscal year (FY) 2011. This is the highest annual amount ever recovered from individuals and companies who attempted to defraud seniors and taxpayers or who sought payments to which they were not entitled.

These findings, released today in the annualHealth Care Fraud and Abuse Control Program (HCFAC) report, are a result of President Obama making the elimination of fraud, waste, and abuse a top priority in his administration. The success of this joint Department of Justice and HHS effort would not have been possible without the Health Care Fraud Prevention & Enforcement Action Team (HEAT), created in 2009 to prevent fraud, waste and abuse in the Medicare and Medicaid programs, and to crack down on the fraud perpetrators who are abusing the system and costing American taxpayers billions of dollars. These efforts to reduce fraud will continue to improve with the new tools and resources provided by the Affordable Care Act.

“This report reflects unprecedented successes by the Departments of Justice and Health and Human Services in aggressively preventing and combating health care fraud, safeguarding precious taxpayer dollars and ensuring the strength of our essential health care programs,” said Attorney General Holder. “We can all be proud of what’s been achieved in the last fiscal year by the department’s prosecutors, analysts and investigators—and by our partners at HHS. These efforts reflect a strong, ongoing commitment to fiscal accountability and to helping the American people at a time when budgets are tight.”

“Fighting fraud is one of our top priorities and we have recovered an unprecedented number of taxpayer dollars,” said Secretary Sebelius. “Our efforts strengthen the integrity of our health care programs, and meet the President’s call for a return to American values that ensure everyone gets a fair shot, everyone does their fair share, and everyone plays by the same rules.”

Approximately $4.1 billion stolen or otherwise improperly obtained from federal health care programs was recovered and returned to the Medicare Trust Funds, the Treasury and others in FY 2011. This is an unprecedented achievement for HCFAC, a joint effort of the two departments to coordinate federal, state and local law enforcement activities to fight health care fraud and abuse.

The recently enacted Affordable Care Act provides additional tools and resources to help fight fraud that will help boost these efforts, including an additional $350 million for HCFAC activities. The administration is already using tools authorized by the Affordable Care Act, including enhanced screenings and enrollment requirements, increased data sharing across government, expanded overpayment recovery efforts, and greater oversight of private insurance abuses.

Since 2009, the Departments of Justice and HHS have enhanced their coordination through HEAT and have increased the number of Medicare Fraud Strike Force teams. During FY 2011, HEAT and the Medicare Fraud Strike Force expanded local partnerships and helped educate Medicare beneficiaries about how to protect themselves against fraud. The departments hosted a series of regional fraud prevention summits around the country, provided free compliance training for providers and other stakeholders and sent letters to state attorneys general urging them to work with HHS and federal, state and local law enforcement officials to mount a substantial outreach campaign to educate seniors and other Medicare beneficiaries about how to prevent scams and fraud.

In FY 2011, the total number of cities with strike force prosecution teams was increased to nine, all of which have teams of investigators and prosecutors from the Justice Department, the FBI and the HHS Office of Inspector General, dedicated to fighting fraud. The strike force teams use advanced data analysis techniques to identify high-billing levels in health care fraud hot spots so that interagency teams can target emerging or migrating schemes along with chronic fraud by criminals masquerading as health care providers or suppliers. In FY 2011, strike force operations charged a record number of 323 defendants, who allegedly collectively billed the Medicare program more than $1 billion. Strike force teams secured 172 guilty pleas, convicted 26 defendants at trial and sentenced 175 defendants to prison. The average prison sentence in strike force cases in FY 2011 was more than 47 months.

Including strike force matters, federal prosecutors filed criminal charges against a total of 1,430 defendants for health care fraud related crimes. This is the highest number of health care fraud defendants charged in a single year in the department’s history. Including strike force matters, a total of 743 defendants were convicted for health care fraud-related crimes during the year.

In criminal matters involving the pharmaceutical and device manufacturing industry, the department obtained 21 criminal convictions and $1.3 billion in criminal fines, forfeitures, restitution and disgorgement under the Food, Drug and Cosmetic Act. These matters included the illegal marketing of medical devices and pharmaceutical products for uses not approved by the Food and Drug Administration (FDA) or the distribution of products that failed to conform to the strength, purity or quality required by the FDA.

The departments also continued their successes in civil health care fraud enforcement during FY 2011. Approximately $2.4 billion was recovered through civil health care fraud cases brought under the False Claims Act (FCA). These matters included unlawful pricing by pharmaceutical manufacturers, illegal marketing of medical devices and pharmaceutical products for uses not approved by the FDA, Medicare fraud by hospitals and other institutional providers, and violations of laws against self-referrals and kickbacks. This marked the second year in a row that more than $2 billion has been recovered in FCA health care matters and, since January 2009, the department has used the False Claims Act to recover more than $6.6 billion in federal health care dollars.

The fraud prevention and enforcement report announced today coincides with the announcement of a proposed rule from the Centers for Medicare and Medicaid Services aimed at recollecting overpayments in the Medicare program. Before the Affordable Care Act, providers and suppliers did not face a deadline for returning taxpayers’ money. Thanks to the Affordable Care Act, there will be a specific timeframe by which self-identified overpayments must be returned. The Obama Administration has made prevention and recollection of overpayments a government-wide priority. These announcements today are just the latest in a series of steps that the administration is taking to protect taxpayer dollars and keep money in the pockets of Americans.

The HCFAC annual report can be found here, oig.hhs.gov/publications/hcfac.asp. For more information on the joint DOJ-HHS Strike Force activities, visit:

http://www.stopmedicarefraud.gov/.

Posted by Luke Short—SurfKY News

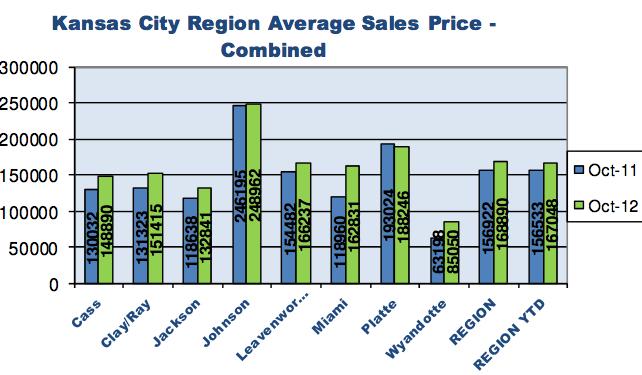

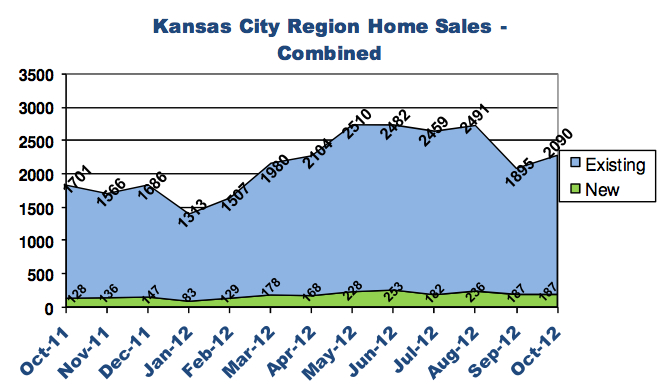

Above: NUMBER OF SALES: October 2012 new & existing home sales (2,277) represent a 24% increase over October 2011 sales (1,829):

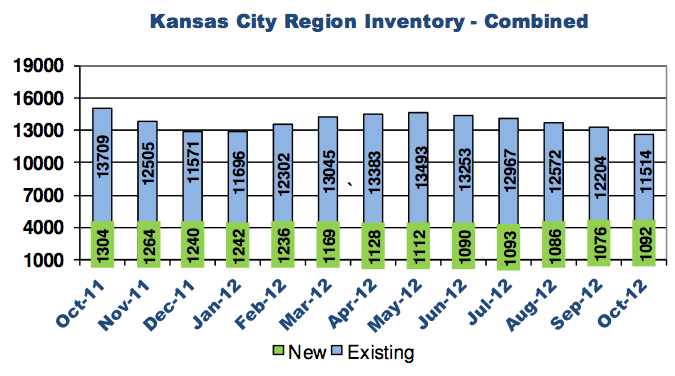

Above: NUMBER OF SALES: October 2012 new & existing home sales (2,277) represent a 24% increase over October 2011 sales (1,829): Above: INVENTORY: October 2012 inventory for new & existing homes (12,606) represents a 16% decrease from the October 2011 new & existing home inventory (15,013).

Above: INVENTORY: October 2012 inventory for new & existing homes (12,606) represents a 16% decrease from the October 2011 new & existing home inventory (15,013).